When looking at Apple stock performance compared to Microsoft, people keep focusing on the wrong thing. They’re looking at stock price and trying to infer if it’ll grow more than some alternative. If your Elephant’s bringing home a paycheck, hopefully you’ve learned a different way to view performance.

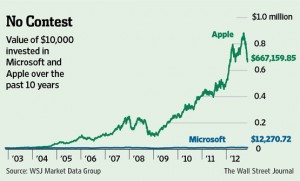

Back in November, the Wall Street Journal wrote an article on Microsoft vs Apple stock performance over the past 10 years. At the time I wrote up my own comparison on my personal blog. I thought it would be helpful to update the article and repost it here as it’s been one of my most popular articles.

The original article compared Apple & Microsoft and tried to reach a conclusion that shows that Microsoft would be a better investment at that time than Apple.

Maybe ((Not really. I was just trying to be nice. I prefer not to use predictions guesses of the future as a basis for investment decisions.)).

The article completely ignored dividend performance over the same time period. It speaks to the financial community’s inability to give credit to dividend analysis as a driver for an investing strategy.

Apple’s stock performance, from a dividend perspective, speaks to why focusing on dividend growth makes for a great long term strategy.

Brett Arends (the original author) didn’t share the exact dates he used to look at the companies’ stock performance, and I couldn’t figure out dates that would fit his numbers exactly. If we do some “back-of-the-napkin” math, we’ll get an analysis that teaches us something interesting, even if we don’t have exact numbers.

Microsoft v Apple Stock Performance Results

Using Brett’s timing and results, we can make some assumptions about how many shares of each company we own:

- The final analysis showed about $13,000 of Microsoft in late November. Using the closing stock price from the day the article was published ($26.95) we’d own about 482 shares. Let’s round that up to 500.

- $700,000 of Apple stock would be about 1,187 shares at the closing price of $589.36 ((Notice how much lower Apple’s stock price is today. Realize that this dividend analysis doesn’t change, even though Apple’s stock price has declined dramatically.)). Let’s round that share amount down ((Notice each time I’m rounding, I’m rounding in a way that makes Apple’s results less favorable.)) to 1,150 shares.

While at the time of the original purchase 10 years ago, neither company had a dividend, both pay dividends today. Microsoft paid some dividends in 2003 & 2004, and started regular payments in 2004. They also paid a $3.00 special dividend in 2004. Apple started paying a dividend in August 2012 and subsequently increased that dividend by over 15% in April 2013.

Had you made the purchases Brett describes you’d receive the following annual paychecks from your portfolio:

- Microsoft’s dividend is $0.92 per year (per share). 500 shares of Microsoft would give you a paycheck from Microsoft of $443.44 per year.

- Apple’s dividend is $12.20 per year (per share). 1,150 Apple shares would give you a paycheck from Apple of over $14,000! That’s right, you’d get 40% more than your original investment back EACH YEAR. Apple’s annual dividend payment 10 1/2 years in is over 30x more than Microsoft’s.

Interestingly, when I first wrote this article before Apple increased their dividend in April, the Apple paycheck was about $12,500. One dividend increase later, and instead of 25% a year more than the original investment the paycheck is 40% a year more than the original investment. And, that doesn’t even take into account any dividend reinvesting.

Let look at this differently. As of today, Microsoft is returning 4.4% as a dividend this year based on the original $10,000 investment. Apple is returning %140 on that same original investment.

Heres’ a short quiz, just to make sure you’re following along:

Which is a better return 4.4% or 140% ((140%))?

The Impact of Dividend Increases

In the last year, both Microsoft and Apple have increased their dividends 15% (neither is a dividend aristocrat). Going forward, if the next increase is also 15% there is a dramatic difference in the raises earned:

- A 15% increase to Microsoft’s dividend would mean a raise of about ¢14, leading to a total raise of $75. A $1.06 total dividend on 500 shares would mean a total dividend of $530, or 5.3% on the original $10,000 investment.

- A 15% increase to Apple’s dividend would mean a raise of about $1.83, leading to a total raise of over $2,100. A total dividend of $14.00 per Apple share would imply a total dividend of $16,100, or 161% of the original investment.

This is a dramatic difference. And, if you’re not really good at math, let me point out that the Apple raise is about 4 times more than the total Microsoft dividend.

Reinvesting these dividends will continue to accelerate this disparity because Apple’s larger dividends work harder than Microsoft’s each subsequent year.

If the Microsoft and Apple stock performance results were even close, we might look at all the extra dividends Microsoft paid during the years when Apple didn’t have a dividend. In this case, even if Microsoft paid the current amount in each of the past 10 years, it still wouldn’t amount to half of what Apple pays out each year now.

The comparison between Microsoft and Apple stock performance for the past 10 years isn’t even close. And, counting dividends it doesn’t look like it’s going to get any better for Microsoft shareholders.

Very interesting!

You could use someone to proofread your writing but I found it informative!

Yeah, it was hard to “rewrite” from the original. I believe it’s a valuable post, so didn’t sweat it too much.