The best part about this raise? I'm getting a raise and I'm not even working a nine-to-five job! Who doesn't love raises? I mean, seriously, what's better than a beautiful day hanging with my kiddos …

Will you have enough saved to retire?

If the stats in this Wall Street Journal piece are any indication, you won't. In 2013, nearly half of US Households didn't even have a retirement savings account. For those that do, the amount …

Continue Reading about Will you have enough saved to retire? →

Who doesn’t love raises?

I came across this great article on the Kiplinger finance site, 12 Dividend Aristocrats for Every Month of the Year. It lists 12 companies and shares some of their dividend history. As a group, …

Exactly what we want to hear from the CFO

Disclosure. I own Apple stock (ticker: AAPL). Last night we heard Apple's CEO and CFO share last quarter's results. As a shareholder, I paid attention to the call -- this time through Twitter. I …

Continue Reading about Exactly what we want to hear from the CFO →

Measure the right things

"Start young" we're all told. It's important to invest over a life-time to build wealth. I came across a great few lines in this short article: The consistent application of a good investing …

Learn from others

Sometimes I write posts to educate. Others, I write to share my observations -- a small nugget that catches my attention and why it's done so can help you get comfortable with investing, with money. …

The secret to investing success

When something is easy, it's often hard to believe that it's true. https://twitter.com/BryanHinmon/status/705059631178063872 Of course, my formula is slightly different for good reason --- My …

Income Inequality

I'm a fan of income, I'm sure you are too. People still dislike the banks, but there's one opinion that says it's not the banks that are the problem: The central economic problem of our time is …

Getting big raises

I know you love raises. I came across an interesting article, The Incredible Growing Dividend. It's written for those with a little more investing background than many readers here, but I feel it …

How long do you want to continue working?

Frankly, I'd like to stop working today. Let me be clear. I'd like to continue working, I'd just prefer not to have to work. Unfortunately, trends aren't in my favor. Or yours, if you think like …

Continue Reading about How long do you want to continue working? →

Jim Cramer talks some sense

I love dividends, but I make the assumption that people have some funds before they get started. Whether the funds are the holding pen where they accumulate money to invest, or they have funds in …

Are you better off today than yesterday?

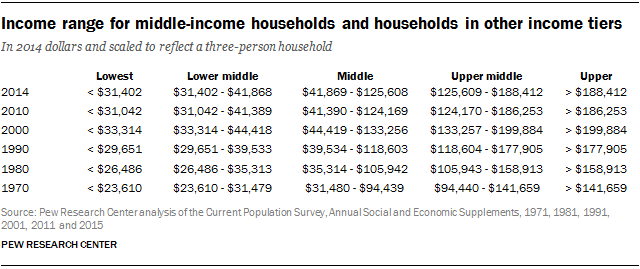

Pew Research has released a long report on the state of the American middle class, and the punch-line isn't very good (there's a short summary too, though you might, as I do, find the numbers in the …

Continue Reading about Are you better off today than yesterday? →