The Elephant’s Paycheck investment strategy for 401K rollovers is simple to understand. Invest in dividend aristocrats and allow dividend reinvestments to amplify your rewards.

What are dividend reinvestments?

When a company pays their dividend, instead of taking that dividend as cash, you reinvest the cash into the company in return for additional shares.

The Benefits of Dividend Reinvestments

When you take your dividend payment in shares instead of cash, all your future dividend payments and Elephant’s Paycheck raises are larger than they would be otherwise.

This really isn’t different than purchasing more shares, except for two key factors:

- Dividend reinvestments don’t (usually) incur a trade commission.

- Dividend reinvestments don’t require whole shares to be purchased.

Both of these points are especially important for modest investors. Modest investors might not be able to invest very often, and if they do, even an $8 commission could be significant. And, modest investors dividends might not be enough to earn a whole share, but they can still participate in the Elephant’s Paycheck Blueprint.

Importantly, when you accumulate extra shares over time the long term amplification of the absolute value of your dividend growth is dramatic.

The Drawbacks of Dividend Reinvestments

Assuming you’re using a brokerage account, and not a dividend reinvestment plan, there is only one drawback. And, that drawback doesn’t apply if you’re investing using an IRA (because it’s tax deferred).

The drawback is that you owe taxes on the dividends received, in the year you receive them, even if those dividends are reinvested. This fact is one of the things that prevents people from understanding the amplification that dividend reinvestments give to your portfolio returns.

How much tax? Not much. As of this writing, the dividend tax is 20%. Dividend taxes are less than those on regular income (federally), and they don’t change the end result — that is, dividend reinvestments are a powerful way to juice your long term results and you might not realize that from looking at your brokerage statements.

How Do You Start Dividend Reinvesting?

Every brokerage account I know of allows dividend reinvestments to be turned on. If you rollover your 401K to a brokerage, have a look under settings or give your brokerage a call to find out how to turn it on. I use (and love) Fidelity. Fidelity lets me turn on dividend reinvestments on a per company basis (so it’s not all or nothing).

There’s another way to get started. This is especially useful for modest investors, because the fees are trivial and you can get started with as little as $250. You can often purchase stock directly from large dividend payers. These accounts came about in a time when you had to buy stocks in “round lots” (multiples of 100 shares) and commissions were in the hundreds of dollars. Direct purchase plans, also called dividend reinvestment plans, were used a way for small long-term investors to participate in company ownership. We’re not going to talk about dividend reinvestment plans here, but get in touch if you want more info.

What Does the IRS Have to Do with Your Elephant?

The IRS cares about how much tax you pay.

Brokerages therefore need to report your financial results in a way that helps you pay your taxes.

Brokerage statements are a reporting mechanism to help you track your portfolio in a way that helps you understand what you have, and how much tax you owe. They’re not a tool for educating you about investing smarter.

Let’s imagine we invest $10,000 in a small business. If some time later, that business is worth $15,000 we can all agree that the business has grown in value by 50%.

If instead of starting a business, you created an Elephant’s Paycheck portfolio, and some time later it was worth the same $15,000 would the IRS say you had 50% growth?

No, they would not.

Remember, you’ve not added another penny out of your pocket. You’ve put that same $10,000 to work as the small business founder did, and at some point in the future find that it’s turned into $15,000. Why the difference?

The difference is taxes.

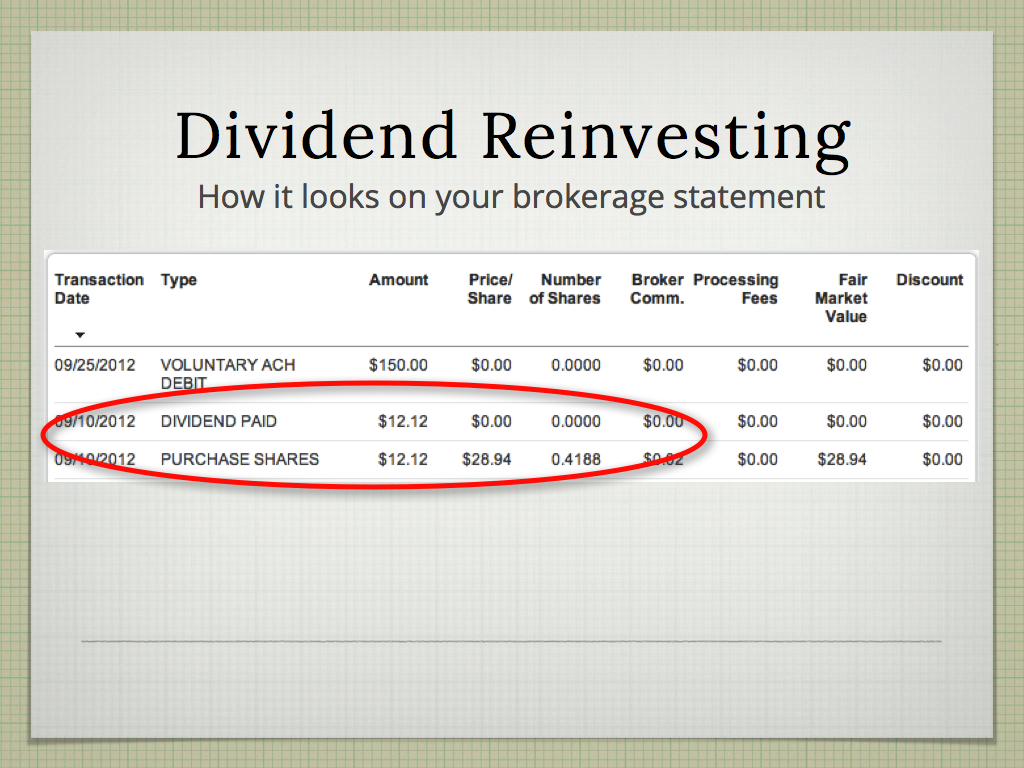

Dividend reinvestments are tracked as two distinct transactions so that the IRS can track the taxes owed. First, the dividend receipt (taxes due this year). Second, the stock purchase (used as the cost basis for the future sale, which will have a tax implication). Brokerages don’t actually realize these are two pieces of the same “event” from your perspective.

The IRS views an Elephant’s Paycheck portfolio as having money added into for each of your dividend reinvestments. That’s just not the only way to look at it. Think of your portfolio as a “side business”. Why would you measure results any differently than if you had opened a coffee shop? Or sell cookies out of your kitchen?

I’m not against paying taxes (or at least, I’m not against complying with tax rules) but it’s not the only best way to measure investing success.

Especially when the account is a retirement account with deferred taxes!

I hope it’s obvious by now.

If you setup a retirement account with $10,000, and at some point in the future have $15,000 you’ve grown by 50%. But you wouldn’t know that from looking at your brokerage statement.

Let’s review this last bit.

Your brokerage account statement measures your success with dividend reinvestments in a way that helps you pay taxes. Even if you’re not paying taxes ((Even if you are paying taxes, your return is higher than the IRS would help you believe.)).

In doing so it understates your return/success.

Of course, understating your return changes your behavior — because as investors we’re seeking the greatest return we can get (in line with how comfortable we are with risk).

What does this mean?

It’s important to educate yourself well to use dividend reinvestments as a tool to help your long term investing success. You can’t rely on anyone else, even your brokerage, to tell you how well you’re actually doing.

A great place to start with your education? The Elephant in the Room has a Paycheck investing blueprint book.

Always reinvest dividends unless you need the cash (usually a bad idea unless it’s in the short term), or are near/at retirement. Tax advantaged plans are the best for it.

That doesn’t mean you should not have them in regular stock portfolios as well, as taxed dividends are still higher then you would get in a savings account now.

Exactly. Investing for dividends, especially when you can “reduce risk” by using safe dividends, a good strategy for long term investing. Reinvesting the dividends is very powerful over time.

Thanks for visiting and sharing.