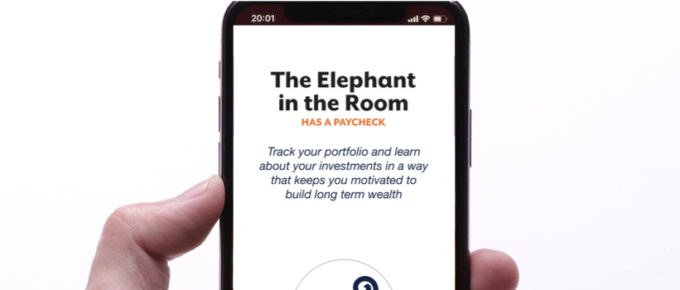

Creating an app instead of using a spreadsheet has always been in the back of my mind, party because I believe it's so important to surface specific metrics that most apps ignore. These metrics, …

What are dividends?

Dividends are payments some companies make to shareholders. Owning shares of stock in the company make one an owner, and as such, they receive these payouts. Dividend payments are not necessarily …

Some Thoughts on Time

When you go to a doctor’s office and they show you a scale from 0 to 10 and ask how much pain you’re in, they never ask how long you’ve been in pain. I was interviewed for my first podcast. The …

Just listen to the CEO

Apple had their annual shareholder meeting yesterday. There's been a lot of discussion about all of Apple's (and others') overseas cash due to the recent tax law changes here in the US. In …

Dividends aren’t everything

Came across this twitter discussion that's worth sharing. I'm a huge believer in dividends, and almost never invest in anything without one... but a company's dividend (other than it's existence) …

Are reinvested dividends income?

Yes reinvested dividends are taxable income. Assuming you’re reinvesting dividends in a regular taxable account. If you’re using a 401k rollover / IRA account, then reinvested dividends are not …

What are Dividends?

40% of total stock returns come from dividends, but what are dividends? From Part 2 of my book: When you purchase shares in a company, you become a partial owner of that company. When buying …

Canadian dividend investors

I worked with an incredible team in Montreal, and know I have readers and owners of my book in Canada. This post is for you, though I can't take any original writing credit on this one. Start with …

The importance of dividends for long term investing

This tweet should speak for itself: https://twitter.com/morganhousel/status/766768750968180736 Dividends and reinvesting are magic, as long as you keep a long term perspective. It's amazing that …

Continue Reading about The importance of dividends for long term investing →

The amazing power of dividends along with other investing truths

I came across a very easy to read article with twelve hard truths about investing and wanted to make sure you read it. It's a fascinating set of points on what people perceive about investing truisms. …

Continue Reading about The amazing power of dividends along with other investing truths →

What happens to big oil dividends if oil prices stay low?

I get asked questions all the time. I thought I'd share some (along with my answers) that might be of general interest starting with this post. On the topic of dividends: what is your take on Big Oil …

Continue Reading about What happens to big oil dividends if oil prices stay low? →

Consistency and commitment

Two more reasons to love dividends: consistency & commitment. From a great blog you should read regularly -- the Reformed Broker: Executives believe that maintaining the dividend is on par with …