I woke up the other day to see Spectra Energy, one of the companies in our sample portfolio ((To get access to the sample portfolio, for now, you’ll need to sign up for our free 10-part email course.)), had jumped 10%. I thought it was a mistake, but looked into it anyways ((A jump that big must have been related to news, so I went to Spectra’s investor relations page to see what happened.)).

Turns out they did some financial transaction with a subsidiary that allowed them to increase their dividend-raise forecast from ¢8/year to ¢12/year.

Dividend Increases are The Gift That Keeps Giving

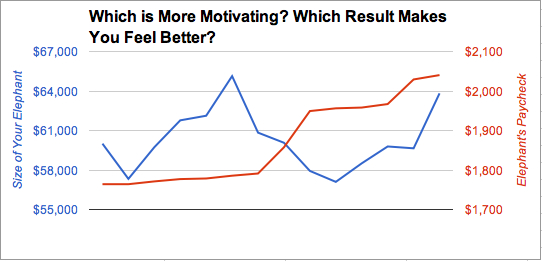

It’s funny. The 10% increase in the stock price was good news, but a one-time piece of good news. The forecasted 50% increase in dividend raises over the next few years is a gift that keeps on giving. Yet people seem to ignore the gift that keeps on giving, and instead focus on the one-time hit of goodness represented by a stock price jump. We are so completely conditioned to look at our portfolio size and not our portfolio income as a measure of success ((I’m reminded of a key rule of business school that “cash flow is king.” In business school terminology, companies manage to their cash flow statement, not their balance sheet. Individual investors do the opposite. We manage to our balance sheet (our portfolio size) and not to our cash flow.)) and this is a perfect example.

This announcement means the dividend will be higher ((Spectra usually increases the dividend in November.)) at each reinvestment, so each reinvestment accelerates my Elephant’s raises.

It means that we can be confident of dividend increases for the next few years (Spectra is not a dividend aristocrat, so knowing to expect raises is reassuring).

It means that the dividend increases will beat inflation, so my Elephant is staying ahead of the “value of money curve” ((I just made that phrase up. It means, his paycheck stays ahead of the increase in prices, so each year he is gaining spending power.)).

Dividend-Raise Press Releases

Dividend forecasts are not made lightly. Missing a public forecast is bad, hitting it provides no upside. Spectra is clearly focused on a quality dividend payout; this is their second dividend forecast news announcement this year. The first in January, shared an intent to raise their dividend at least ¢8 a year for “the next several” years.

They did change their wording this time. January’s release said “at least ¢8 per year”. This announcement used the phrase “approximately ¢12”. It seems that they’re giving themselves a little wiggle room in case this was too aggressive, but it’s definitely higher than the original ¢8 forecast. The market loved the news, sending the stock up 10% for the day.

Let’s have a quick look at the math behind our Elephant’s upcoming raises. ¢12 is a ~10% raise. They’ve announced that they’ll keep the ¢12 raise up for a few years, but the % raise will decrease as the dividend gets higher. Currently the dividend is $1.22, so a ¢12 raise is a 9.84% raise. Next year, after a ¢12 raise the dividend will be $1.34, so a ¢12 raise is ‘only’ 9%. Year 3, 8.22% raise. You can see that the %-raise decreases over time if the increase is a fixed amount ((Remember, we get raises from both dividend increases AND reinvestments, so these raises are only one component of the increases.)).

Pivoting Your Perspective to the Elephant’s Paycheck

In addition to understanding the power of dividends and dividend raises there are 2 key points we can use as a way to understand the Elephant’s Paycheck a little bit better.

- Most people will judge their success only by portfolio growth. Therefore, they’ll see last week’s 10% stock price jump in their rear-view mirror and feel that they missed out.The difficulty is that you can’t possibly know about something like that ahead of time. If you did, especially as an individual investor, everyone would know and the stock wouldn’t jump like that (or you’d be insider trading).You can’t really know ahead of time, but we act as if we should be able to know. This adds to our frustration with investing, our feelings that it’s not fair (someone must have known, we think), and our expectations that we should be able to invest in a way that helps us capture these sorts of moves (in turn leading to erratic investing behavior).If instead, you value the dividend raise, you know it’s increasing. It’s a sure thing (or as sure a thing as it gets). Measure that raise and you’ll feel good about what you’re doing and know that you’re making measurable progress towards your retirement goals.Don’t forget, you’re also increasing your purchasing power over time. You’re actually getting ahead of the Jones’.

- Sometimes companies tell you what their dividend plans are. In our free 10-part email course we spend a whole lesson (lesson #10) talking about what news to pay attention to and where to get it. This is the sort of news you want to pay attention to so that you learn, but don’t make yourself crazy. This information doesn’t always come in the form of a press release. Sometimes, it’s talked about on conference calls (Look at the bottom of page 24, or search for ‘payout ratio’ — it’s the first search result).

[Update] In the picture at the top, the blue line is the size of the Elephant. Notice how it goes up and down. It’s an emotional roller coaster. The red line, the one going up and to the right consistently, is the Elephant’s Paycheck. We like things that go up and to the right almost-all the time. When you invest and are rewarded by ‘positive results’ you continue to invest. If you measure your Elephant’s Paycheck you have a positive reward correlated to your behavior, which in turn motivates good behavior (and reduces anxiety).

Let me know what you think