The hypothetical investor who captured the entire 128,000% return over the last nearly sixty years would have experienced plenty of discomfort along the way. Disney has seen eight separate drawdowns of at least thirty percent. To be clear, what this means is that on eight different occasions, Disney would hit new all-time highs and then fall by at least thirty percent.

I came across an article ‘Totally Absorbed’ yesterday.

I read it, closed the browser tab, and moved on in my day. When I woke this morning, it was the first thing on my mind (not to be confused with my face, on which lay my son’s foot). I knew I had to share it.

Totally Absorbed speaks to the discomfort of investing. Even “winners,” rare as they are, put us through emotional turmoil over the lifetime of our ownership. Winners like Disney and Apple, who everyone that invests hears about, have been down quite a bit over their lifetime. As an example, Disney has been 20% down from it’s high’s for 55% of the time. Even though it’s grown an astonishing 128,000% since its 1957 IPO.

How does that make you feel?

When you question you plan, keep this in mind. It may feel like you’re always lower than a recent high.

You are.

That’s how it works.

Up and to the right baby!

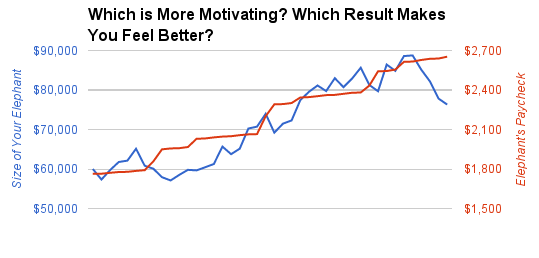

As I’ve written the Elephant in the Room has a Paycheck (buy it here) I’ve been maintaining a sample portfolio, tracking results and charting them on a monthly basis. Especially with the recent downturn, the spreadsheet serves as a powerful reminder of the value of the Elephant’s Paycheck.

Have a look at the blue line. That represents the total portfolio value. (You can see the data on the ‘history’ tab of the sample portfolio spreadsheet.) You see how it goes up and down. In fact right after starting it dropped — for three months. How’s that for demotivating. Then it went up — yay! But back down, even lower than before. Boo. And so on. I mean, it’s an emotional roller coaster. But that’s what stock prices do. They go up and down, often without any apparent reason.

Look at the red line though.

Notice anything?

It keeps going up. Nice, huh?

Not only great because it means something is growing (it’s the Paycheck!). But also because it keeps us emotionally steady and not whipsawed by the ups-and-downs of the market. In fact, tying this back to the article that inspired this post, if you had purchased Disney at the IPO you’d spend more than half your time owning the stock down more than 20% — worried, anxious.

Don’t tell me how to feel, I love my misery

That’s exactly the opposite of how being responsible should feel. And, that’s why The Elephant in the Room has a Paycheck is unique. Not because it uses some magical investing technique never seen before. But because it uses tried-and-true techniques with unique metrics to help keep you motivated to stick to your plan. To help you understand the value of starting young and planing for a secure future.

Anyways, back on point. If you read anything this weekend, read ‘Totally Absorbed’. It’s short and will help you realize that you’re not crazy for always feeling anxious about how your investments are doing.

Update: Here’s another post that discusses the same sort of long-term pain you can expect, even from the biggest winners.

Let me know what you think