I’m always surprised when I hear about people cashing in their 401(k)‘s when switching jobs. Or others who simply don’t save for retirement… even those who are far from retirement.

Surprise maybe isn’t the right word. It’s more like despair.

I worry about people who won’t be able to retire. But, I’m not sure I have a good picture of how little people have saved. It’s so hard to know when no one really talks about this stuff.

A recent GAO report, Retirement Security, sheds light on the situation, and it’s dire. Even the subhead of the report is shocking:

Most households approaching retirement have low savings

That statement is further qualified in the abstract of the findings:

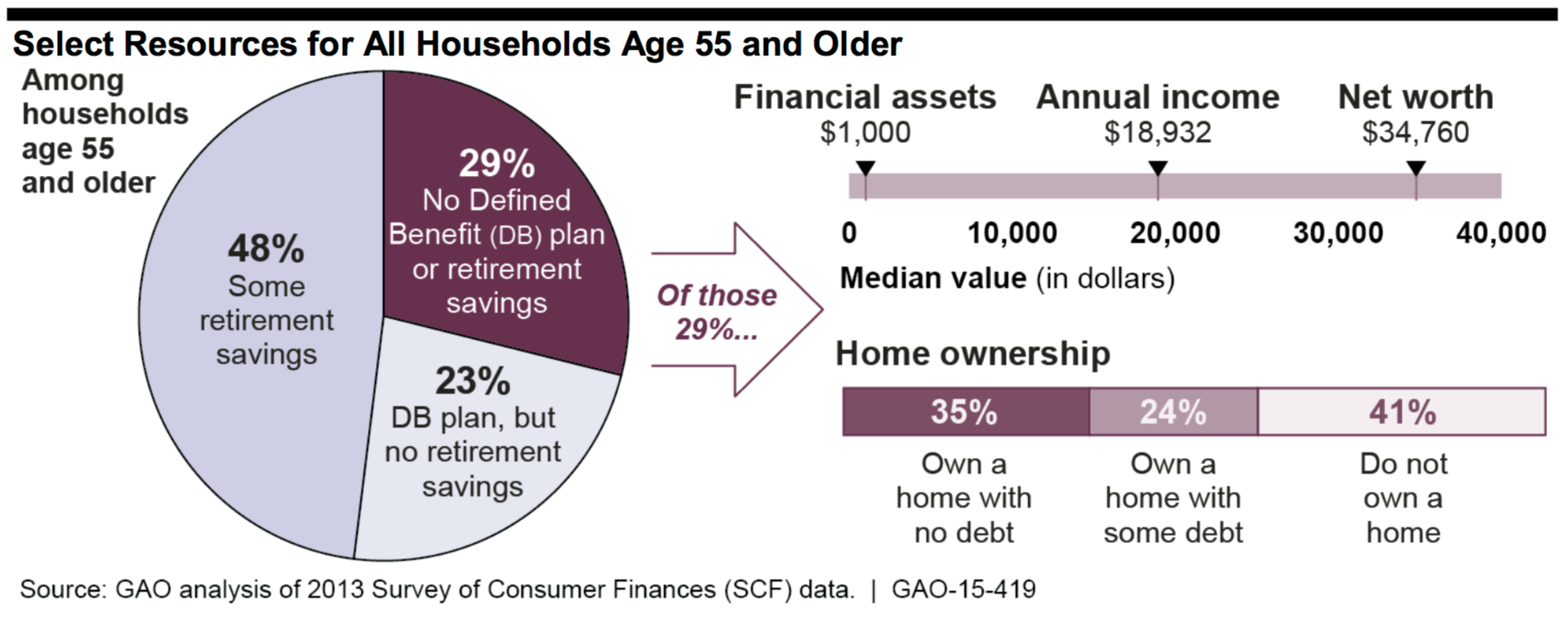

Among households age 55 and older, about 29 percent have neither retirement savings nor a defined benefit plan, which typically provides a monthly payment for life.

Looking further:

About 55% of households age 55–64 have less than $25,000 in retirement savings, including 41 percent who have zero

Mostly you hear that people will have to work longer or work in retirement. What you don’t hear is:

Half of retirees said they retired earlier than planned due to health problems, changes at their workplace, or other factors, suggesting that many workers may be overestimating their future retirement income and savings

If working longer is the answer, but health or workplace changes prevent that, what do you do?

For starters, if you’re young enough, you best plan ahead. I am understanding my retirement savings from the perspective of the income they can provide in retirement. This way I can plan more accurately, both in how I spend money in retirement but also what I can expect as I get closer.

I’m a huge believer in making the most advantage of tax-free or tax-deferred investing. Please don’t cash in your 401(k) when you switch jobs. I know it can be scary when you see it drop all the time, but rolling over your 401(k) into an IRA can be fun. It’s easy to do, and a great opportunity to develop a side income stream that will help you plan better for your (and your family’s) financial future.

If you’re unsure of what to do, drop me a note.

The GAO report should scare you. It scares me, and I’m not someone who’s unprepared. But, while fear is a good motivator for some, I think fun is a better motivator. Let me help you have fun investing, and who knows? Maybe you can retire earlier than you thought.

Let me know what you think