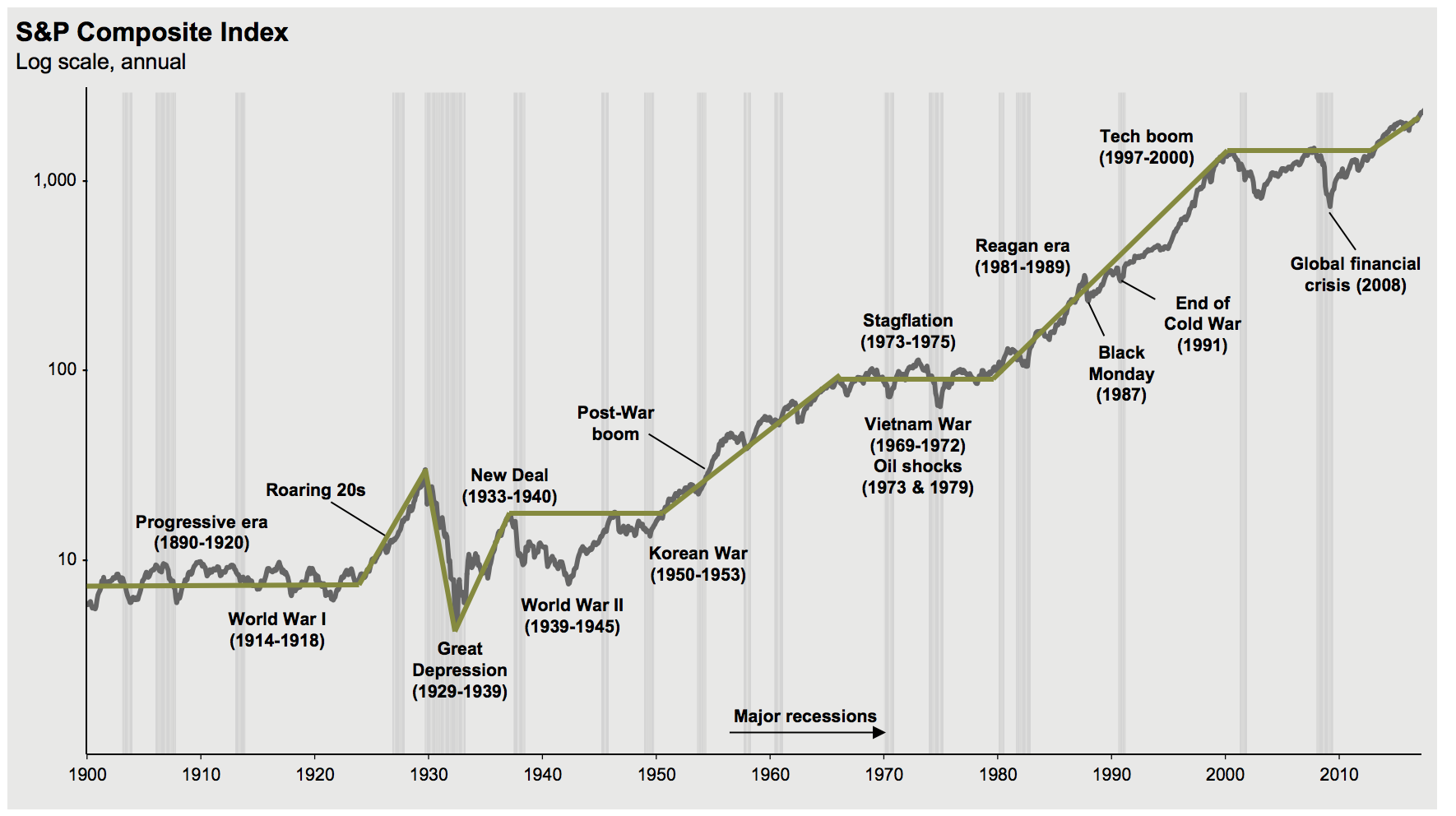

I feel this is a really important question as learning is a lifelong practice. And, investing well over a lifetime is about learning the basics so that over time you make increasingly better …

Continue Reading about How can you get your child interested in investing? →