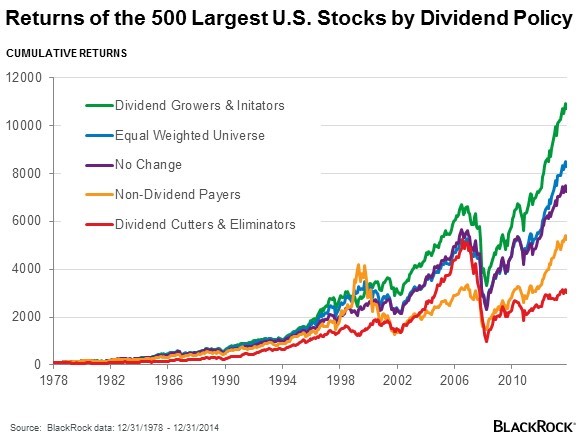

Look at that dark green line. That’s where you want to be — over 30% greater returns than the next best grouping of stocks.

Notice the long timeline of this chart. When you have a long time horizon, and stick to your strategy, you can do really well regardless of shorter-term market dynamics (like the internet boom/bust of the late 90’s or the recession of 2008/9).

The challenge about long term investing is that you can’t go back in time. Once you’ve ‘placed your bets’ you’ve got to ride them out. That’s why I like to use history as my guide.

Focus

From Blackrock’s blog, an easy to read post on dividend investing and how it’s changed over time: ‘where dividend investors are seeking income’

It’s fashionable in the market to focus on growth. Yet so many of the new economy luminaries don’t pay a dividend – not yet anyway. No matter. Whether it’s caring for people or helping them communicate, there’s nothing old-fashioned about total returns that top the market. Focus on quality businesses capable of sustaining and growing earnings – and dividends.

Here at Elephant’s Paycheck we believe in the same and know just where to find companies that are capable of sustaining and growing dividends. We also know how to find companies who have the intent of using growing earnings to increase the dividend.

Dividend aristocrats

If you recall, dividend aristocrats are large companies who have increased their dividends every year for at least the past 25 years in a row.

I have a daughter now. When she’s dating I hope I’ll have the opportunity to share advice. The biggest piece of advice is knowing if a guy likes you. How do you know? Look at his behavior. Does he want to spend time with you? He’ll telegraph his feelings with his behavior.

Executives and company leadership do the same. They telegraph their values with their behavior. Companies that value the dividend increase it, and manage their business to protect their ability to do so.

Sometimes, it’s not even as difficult as that. Both GE & Apple have said explicitly on earnings calls recently that they intend to increase their dividends regularly. Neither are aristocrats, but if you hear a clue like that it’s a company that would fit into an Elephant’s Paycheck portfolio.

Of course, there’s still risk. Just because they have an established history doesn’t mean they’ll be able to keep it up. (Financial people like to say past performance does not guarantee future results.) During the late 2000’s GE & Bank of America were forced to cut their dividend. Having been aristocrats, that was a tough time. That’s why we select a portfolio of companies for our Elephant’s Paycheck portfolio.

That good feeling

If you’re just getting started investing, getting a dividend check, even a small one, is fun.

Investing in aristocrats (and then reinvesting the dividend payments) helps you be certain that your Elephant’s Paycheck increases over time for as long as you keep your portfolio.

It’s like your portfolio is a business and you have just gotten your first paycheck.

I’ll never forget mine.

Let me know what you think