I’m going to share step-by-step instructions for buying Apple stock even if you’ve never invested before.

The stock market has been up-and-down lately, but good companies, especially those with a lot of money in the bank, they do well over time. It’s always a good time to get started investing, especially so now, as learning something feels empowering.

Apple is one of those companies. At the moment, it has plenty of money in the bank, a dividend yield over over 1.1%, and seemingly lots of innovation on the horizon.

One could, and many do, argue about whether the next iPhone will sell, or if the virus is going to cause them to delay the next iPhone, or other products, and so on. These arguments are not so interesting. They’re short term, and don’t speak to the company’s visitor of the future.

Two interesting things come to mind when thinking about the future of Apple.

- Apple just put a LiDAR “camera” in the high-end iPad Pro. In short, the LiDAR “camera” allows the iPad to instantly sense the physical environment. This is really useful in augmented reality and setting the stage for the future of autonomous systems and smart glasses among other things. This exactly the long-term play that Apple is really good at that is extremely defensible (meaning, it’s really hard to compete with Apple because of the sum-total of it’s offerings, even if someone else has an even better LiDAR camera; for example, Apple has a whole ecosystem of software developers to create solutions using this camera, something no other mobile platform has.)

- In Tim Cook’s (Apple CEO) own words: “If you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ It will be about health.” And, we see small pieces of that with the face shields Apple designed to combat the coronavirus and the APIs they’re working on with Google for contact-tracing. Consider that Apple has just barely started in Healthcare, and yet the CEO believes it will be bigger than anything they’ve done before.

How to buy shares of Apple, even if you have a small amount of money just to get started:

- Get $5 ready — that’s all you need to get started.

Yep, you no longer need lots of money to get started investing.

- Head to Stockpile (or download the app for iOS or Android)

This is not an affiliate link, I don’t earn anything from this recommendation. I use stockpile myself and as a custodian for my children.

Stockpile supports fractional shares, which means you don’t need to buy a whole share. You can invest what you can afford and still participate in a popular company like Apple that has a high share price.

Don’t confuse high share price with “expensive”. To determine if something is expensive is different because it relates to how many share exists (what percentage of the company you are buying when you buy a share) and the value of the company (which is anyone’s guess anyways).

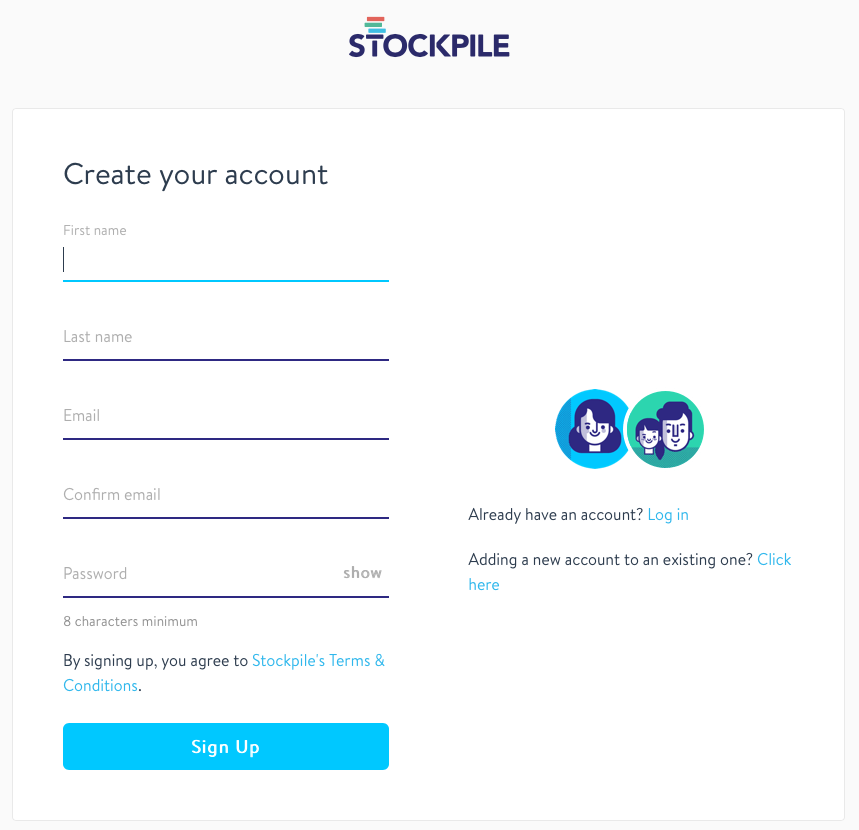

Before fractional share purchasing, you’d need to invest as much as the price of a share just to get started. Now, with Stockpile, you can buy as little as $5 of Apple stock to get started. - Create an account

Pretty straightforward, you can check it out with out investing just by creating an account.

- Connect your bank account

Don’t use a credit card, the fees/commissions are too high.

Some would argue that even the $0.99 commission is too high, especially if you’re investing just a small amount. I’d argue that if you’re just getting started, the $0.99 is more like spending on learning something, and over time you’ll learn so much from just getting started — way more than reading tons of books (even mine!). - Schedule a purchase

Stockpile is for investors, not traders. They purchase once at the end of the day so when you click “buy” you’re actually scheduling the purchase for the close of market on that day. I do it all the time.

Once you do, you’ll get an email the next day telling you that the trade is complete (congratulations!) and you can check online to see for yourself. - Bonus #1: Reinvest dividends

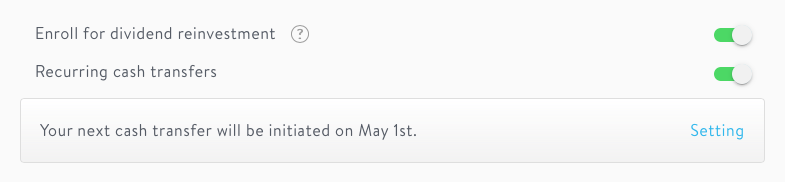

Reinvesting dividends compounds them over time. It’s a great practice for small investors thinking long-term.

In Stockpile, head to your account settings, and make sure the switch is turned on as shown in this image from my account:

One Stockpile limitation is that this setting is for your account, so any company you own that pays a dividend will be reinvested or none of them will. There’s no way do make this decision on a stock-by-stock basis using the website or app (I think you can email support and they can do it manually). This really isn’t a big limitation in my opinion. - Bonus #2: Setup a monthly recurring purchase

If you can, setup a monthly recurring purchase so that you accumulate more stock over time. Remember, each time you accumulate more stock, your dividend paycheck gets bigger too (who doesn’t like a raise?).

- Bonus #3: Setup a custodial account for a minor

Stockpile has made the custodial process really simple for teaching children about investing. I use it for my kids, and it’s so much easier than how it used to be using traditional brokerage companies. Plus, custodial accounts have the same $5 minimum to get started as do regular accounts, whereas before Stockpile a minimum of $250 was common.

Some people will argue that it’s not worth doing this because it’s not tax deductible, setup a college savings account. They’re half-right. You should setup a college savings account. However, putting aside a little money in Stockpile to teach children about investing is an important investment in financial education that they won’t get if you “just” do a college savings account. It’s an investment that will, wait for it, pay dividends long into the future.

Once you’ve completed these steps, have a look at Money Making Money, where you can learn more about what you’ve just done, how to have fun when the market is like a roller coaster, and how you’ve just taken your first big step towards financial freedom.

Let me know what you think