Well, a 200 point drop in the stock market doesn’t matter to your Elephant.

Let’s take our sample portfolio. Our sample portfolio started about a year ago with $60,000. Our Elephant’s Paycheck was $1,760 (annually). Currently, our Elephant’s Paycheck is $2,040.

It was $2,040 yesterday morning when we woke up. It was $2,040 when the market closed down 200 points.

This is an important aspect of the Elephant’s Paycheck Blueprint. By focusing on the right metric, we stay steady and motivated. Confident in our progress towards our financial goals, we will stick to the plan without getting spooked by a short term drop in the stock market.

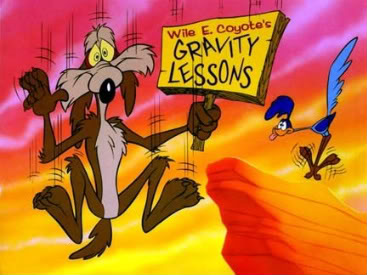

Ups and downs of the market are transient. There is risk. As I like to tell people, there’s no law of reverse gravity in the market. If something goes down, it may not come back.

Ups and downs of the market are transient. There is risk. As I like to tell people, there’s no law of reverse gravity in the market. If something goes down, it may not come back.

However, remember that our investments are (should be!) mainly dividend aristocrats. Dividend aristocrats have a 25+ year history of raising their dividends. That doesn’t mean it will continue into the future always and forever. It does, however, mean that something would would have to be materially wrong for that pattern to change. And, that wrong-ness is something we, as individual investors investing in alignment with our social values and personal interests can pick up on (in my opinion, sometimes better than professional analysts).

When a large drop in the stock market occurs, I like to reassure myself that my next dividend reinvestments will give my Elephant a larger raise than expected ((Because the reinvested dividend buys more shares when the share price is lower. More shares equals a larger dividend increase for all future dividends.)). Remember, the raises are a gift that keeps on giving, and you’ll benefit from this temporary drop for a long time to come.

Let me know what you think