It’s a deep part of American culture to own our homes. There’s a lot of government policy to support this too, not least of which is the tax break provided to mortgage interest. That said, my gut …

Do you own gun stocks?

You almost definitely own gun stocks if you invest in mutual funds. Sorry if that's bad news. I own a sword. A real sharp sword. I would have no problem having to register it, or having rules …

The discomfort of investing

The hypothetical investor who captured the entire 128,000% return over the last nearly sixty years would have experienced plenty of discomfort along the way. Disney has seen eight separate drawdowns …

Exactly what I’m talking about

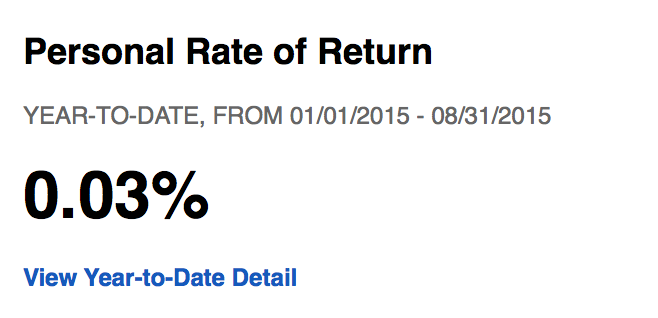

It's been a rough month. The "market" has corrected, and pretty much every stock and fund is down. At least the ones I own. I logged in this morning to look for my latest 401(k) deposit, and saw …

My book may not be for you

Now that I have actual readers, I'm learning quite a bit about what I've written and how it's received. This book may not be for you... Early in the process, I realized that I needed to ask myself …

Thinking about pay raises

Have you gotten a pay raise lately? Probably a better question is: are you working at the level you're capable/trained for, or are you just grateful to have a job with benefits? I got a pay raise at …

The most concise guide to dividend investing

It's been a while since I put any thoughts to paper. Though the sample portfolio I created is doing quite well with over a 48% raise in the three years since I started thinking about the project "the …

Continue Reading about The most concise guide to dividend investing →

Social Security Benefit Increases Suck

Forget the argument of whether or not Social Security will be available when you retire. Forget your concerns about the amount of your social security payments, or when to start taking Social …

Continue Reading about Social Security Benefit Increases Suck →

Shocking 401K Statistic

Reading a Money Magazine article on the best moves for millennials to build wealth, I came across this shocking statistic about how the 25-34 year old age group treats their 401K's when they switch …

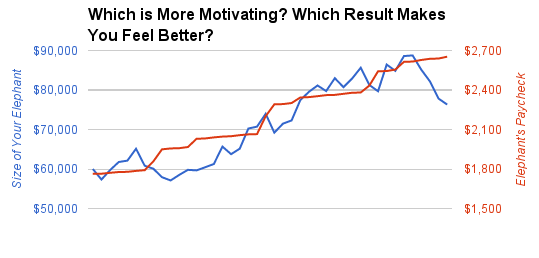

How to Get a Big Pay Raise Every Year

Growth is an important part of investing, right? Do better this year than last year. Better next year than this year. At work, you think in terms of a big pay raise to measure doing better year over …

Continue Reading about How to Get a Big Pay Raise Every Year →