Robinhood is a glimpse into what every brokerage should be in a mobile first world. It’s got a nice clear interface that makes investing fun, in a way that looking at bank statements is the opposite of fun.

It’s bewildering that every brokerage hasn’t yet downloaded the app and copied it to improve their own mobile trading offerings. I’m literally shaking my head in disbelief at my own banks as I write this.

The only challenge I have personally, and for the Elephant’s Paycheck community, is that Robinhood doesn’t yet support dividend reinvesting. That missing feature unfortunately makes Robinhood a shiny bauble for me (pretty, but not good for much), at least until they ship a dividend reinvesting feature (which they say is coming).

TL;DR

If I were to write review of Robinhood that didn’t reflect Elephant’s Paycheck, it would be simple:

Robinhood is the app that every mobile brokerage should have written. If you invest in the stock market, you should stop reading this and go download it. It’s legit, it’s free, and it’ll give you a glimpse of the future of trading.

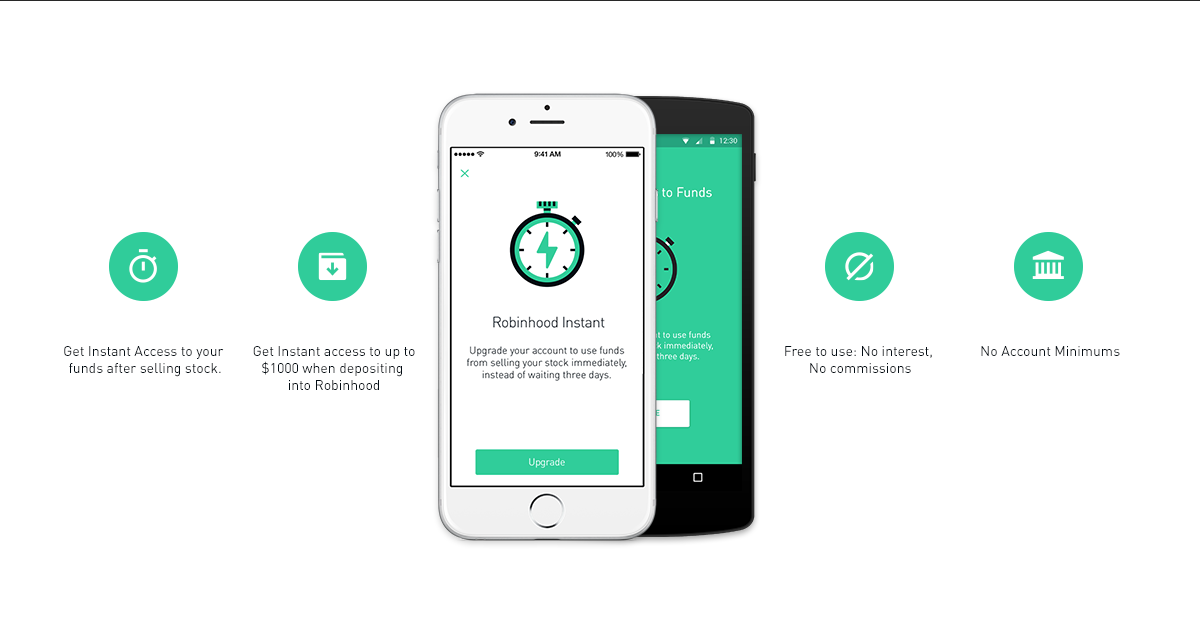

There is some real innovation in what Robinhood has done (integration with StockTwits & Robinhood Instant), and more coming.

Because they don’t charge trading commissions, it’s easy to invest small amounts and get started financially. Unfortunately, creating a long term investing habit is a bit harder and they don’t do anything to encourage long-term habit changes for new investors who want to do more. This is so critical, not for a trading app but for the ‘people’. Building legacy wealth doesn’t happen easily. Robinhood helps anyone take their first steps towards creating a better financial life and I hope they do more to help create healthy long-term investing habits.

The biggest question you’ll probably have is how they make money — and they answer that right up front on their FAQ.

As I mentioned above, the lack of dividend reinvesting makes it a non-starter for people using the Elephant’s Paycheck Blueprint to build long term wealth. While it is easy to reinvest dividends manually (because there aren’t any commissions for trading), the problem for modest investors will come in if you don’t get enough dividends to buy a whole share. You’d have to wait for multiple dividend payments until you save up enough to buy one extra share. All that time, it’s too easy to miss the opportunity to appreciate how your paycheck grows with each investment.

While small dividends don’t matter so much from an absolute value, each penny reinvested has a big relative impact (percentage increase to your Elephant’s Paycheck). The Elephant’s Paycheck Blueprint takes a human approach to investing. Using the metaphor of a portfolio ‘paycheck’ and tracking how it grows as an alternative tracking the total portfolio value (which makes gut-wrenching adjustments according to market volatility) maximizes the positive rewards that help to reinforce good investing habits.

If you’re new to this blog, you might be interested in a popular post about metrics that help you have fun investing that I wrote for the fantastic dividend site Sure Dividend.

Robinhood pros

- I love dividends, so I’m putting this first. In the history tab, you see upcoming dividend amounts and the dates you’ll receive them. Simple, clean, and inexplicably hard to find on a regular brokerage site.

- Free trading means you can get started modestly. Small investments don’t necessitate big returns just to overcome the transaction cost. With a traditional brokerage, if you buy a $30 share, and pay $8 for the privilege, at a regular brokerage you need about a 25% return just to break even.

- Robinhood Instant means that money transfers into Robinhood are available to trade right away (with limits), no three day ACH delays. This is a serious innovation, and they’re working on similar ease of use around margin trading as well.

- You can buy individual stocks, and aren’t limited to ETFs or Funds (like with Stash). I like individual stocks, many do not. I like the way it’s easy to find out a lot about individual companies, whereas I find funds/ETFs to be opaque.

- No minimums to get started. Amazing. They really understand the importance of removing barriers and helping people get started. And since the UI is quite nice, it’s easy to get started technically as well as financially. What’s lacking is anything that helps motivate people to stick with investing over the long-term.

- If you’re an experienced trader, Robinhood will resonate. It’s exactly what you’d think a brokerage trading app should be in the mobile age.

- Integration with StockTwits is likely a preview of what you’ll see more of in the future (in StockTwits simply hit “add portfolio” and it’s updated so you can track your portfolio. Really easy.) As I was taking notes, multiple times I wrote “great example of their trajectory”. I think Robinhood is really interesting and very exciting. The other company that comes to mind as a parallel on the innovating things they’re doing to help people get started investing is SparkGift.

- It’s on both iOS and Android.

Robinhood cons

- No dividend reinvesting.

- They’re not doing anything to make investing more motivating; so I don’t know if this will attract people who don’t trust banks, or who are “scared” of investing. They’re not lowering the emotional barrier to entry (the same way they have lowered the financial barrier to entry). They’re also not motivating continued participation (the way I think I am here with Elephant’s Paycheck and the way Stash does with auto-Stash).

- You have to buy whole shares of stock, you can’t just buy $50 of a company. And, you can’t automate the process to invest $50/month as a way to build wealth.

- Email support was a bit hit-or-miss, but they answered the phone right away.

- Phone support didn’t give me the “confidence” I get from my brokerage. This is a very personal and subjective thing. I’m older which affects my perception and expectations as well. I do trust Robinhood 100%, but if you’re an older investor you may have to put aside some uneasy feelings if you call support (and I suggest that you do put them aside).

- I’m not a fan of some of the UI elements and design choices. The card-based news items never seem relevant or interesting, and it doesn’t feel very iOS-like.

- Doesn’t support 1Password, which them means passwords are going to be weaker than they could be otherwise.

What I bought

I bought 5 shares of $AFL (Aflac) and 19 of $ADM (Archer Daniels Midland), both of which pay dividends this month (June)!

In closing

Pay attention to the small details of what Robinhood are doing. The details are innovative in a subtle way. They seem to be designed to minimize friction. Minimizing friction is what’s going to make it impossible for big banks to compete, and it’s going to be a fun fight to watch over time. (My money’s on Robinhood not the traditional brokerages.)

Also, I’m really interested in the integration with StockTwits and how they combine what they know you’ve done in your brokerage (such as owning a specific company) with your social clout on the site. It’s going to change social investing over the longer arc of time in ways that will deepen Robinhood’s relationship with millennials.

It’s free, it’s mobile, it’s frictionless. what more do I need to say?

It’s the perfect solution for non-dividend people who aren’t afraid of the stock market. And, I don’t give away ‘perfect’ easily.

I hope you like this review. I welcome comments below and private messages to discuss.

Addendum

If you’re technical and use Gmail, you can use IFTTT to create workflows that automatically populate a spreadsheet with your holdings to track your portfolio (instead of having to track it manually).

Let me know what you think