Update April 4, 2016

I want to make sure readers see this feature update announced today so I’m putting it here at the top (and to hell with SEO optimization!).

Today, Stash Invest introduced “Auto-Stash”. It’s a way to automate investing small amounts regularly. This is so important to building wealth one-day at-a-time for modest investors.

What are you waiting for, grab $5 (that’s all you need to get started) and go check it out! (iOS or Android). Heck Stash will even give you the $5 to help you get started if you use this link to download the app. What could be easier?

Update August 2017

Stash has hit the 1,000,000 customer milestone! Crazy and good for Stash.

Overall

Man if this is the future, it’s exciting. Stash is pleasing to the eye, approachable, and very easy to get started.

Their positioning on purpose is interesting and unique:

The @StashInvest way: Buy, Hold, Add #Investing #Retirement Click To TweetThe Stash Way: Buy, hold, add.

Stash is designed for holding investments over the long term — not for frequent trading. Why? It’s easier to get it right. If you try to predict whether an investment will go up or down in the short term, there’s a good chance you’ll get it wrong. Long term investing is also less stressful, since you don’t have to obsess over daily or weekly price fluctuations of your investments. Over the long term, the market has grown about 10% per year*. So make some investments, hold onto them, and make more investments on a regular basis. And remember, every dollar you put toward growing your Stash is a dollar you are saving, and not spending.

Pros

- Encourages buy & hold

- Easily, very easily, invest small amounts regularly

- Low fees, and fees align to their core value of buy, hold, add (this is very important because it means their incentive are aligned to their customers — meaning, they are successful when their customer are successful)

- Well designed UI

- Allows you to invest in alignment to your values

My book and Stash are two different ways to get to the same place — financial security and family wealth.

Cons

- They’re enabling only Mutual Funds & ETFs, no individual stocks. For someone just trying to get started, this shouldn’t be a barrier to entry. Stash is not a good app for creating an Elephant’s Paycheck portfolio. Otherwise, go for it! If, like me, you prefer to buy individual stocks — here’s $5 to get started with Stockpile. Using Stockpile you can buy fractional shares and reinvest dividends, and even buy stocks for your kids and relatives and track them all in one place.

- The only tracking metric is portfolio value. Which is really not a healthy way to build a regular investing habit (I’ll discuss this in detail below). Users emotions get killed by expected (and normal) market volatility. If you’re interested in reading about different ways to measure success have a look at: what else to measure and why.

- The app doesn’t work offline. If I want to check on my portfolio status on my commute (NYC Subway) or airplane, I’m out of luck. This is a pet peeve about banking apps; and frankly, it shows poor care for experience that doesn’t endear me to the solution.

- Fee disclosure wasn’t very clear during the sign up process (though they are very clear in the FAQ).

- Notifications are done via email, not mobile notifications (Apple Watch, hello). There are notifications in app, but they don’t include all the notifications in email so now I’m getting more email that I don’t want, and notifications in the app that I have to dismiss even though I’m getting them in email too. This should be easily fixable, if they have the priority to do so. They’ve got to support the Apple Watch, and do so properly.

It’s not enough to make investing easy, it needs to be made motivating

Let’s consider the tracking metric mentioned in the second bullet. (For additional thoughts read: changing the investing metrics we track).

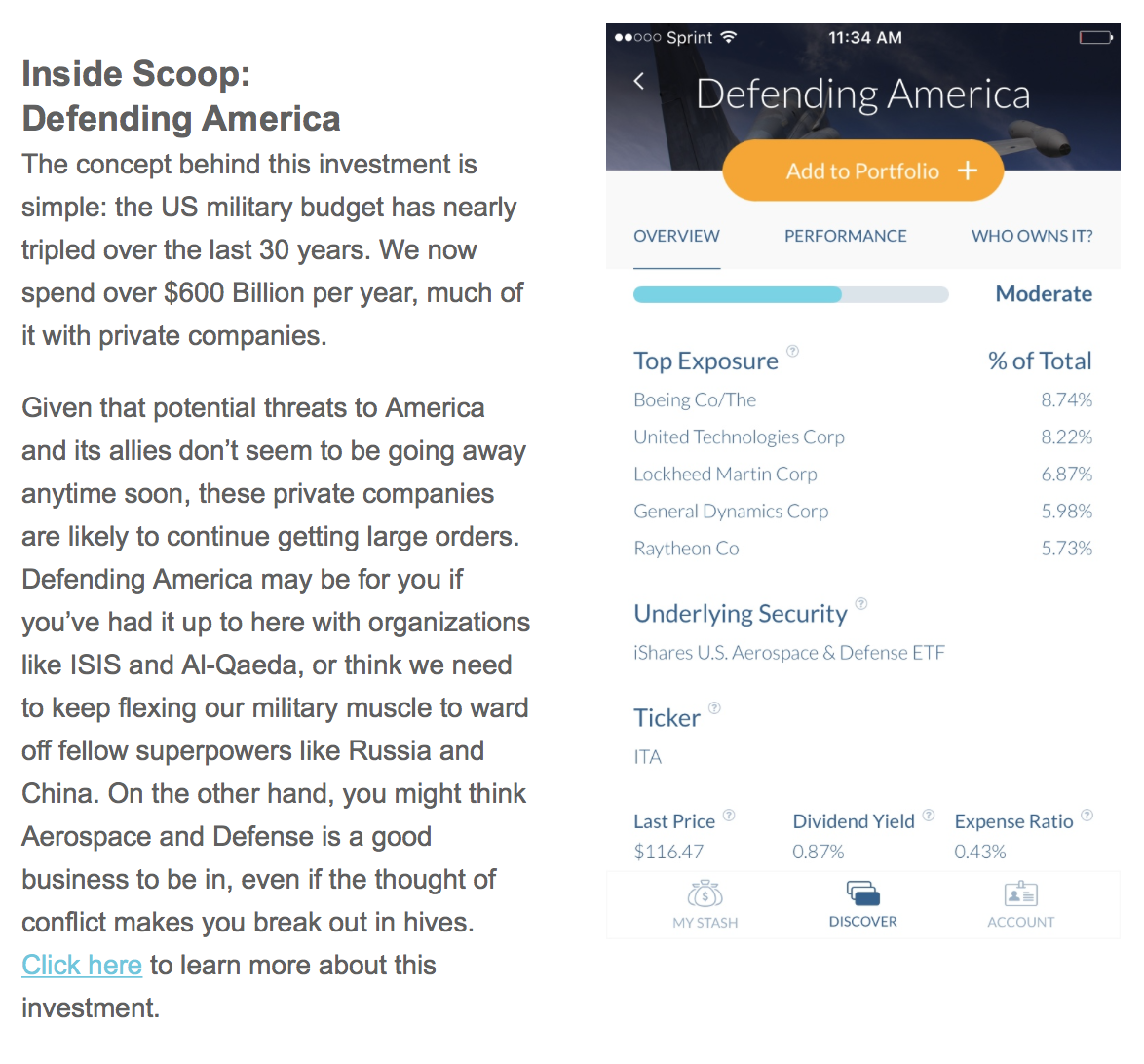

In the screen shot to the right, you see a loss. Forget that it’s just $0.30… it’s down over 1.5%. Boo! Not a very motivating screen.

Can’t blame the Stash team of course, this is exactly what it would look like on your bank statement or what most advisors would tell you. Of course, this sort of accounting is really done for the IRS, and for some reason everyone has decided to measure the success of their portfolios based on how much tax they owe.

There’s another good screen though, on the tab called “potential”. A simple slider allows you to dream about the return you might get, and what impact it will have on your wealth.

The challenge, from a motivation perspective is that any negative reinforcement of the “how am I doing?” portfolio screen is going to

overwhelm the hopeful feelings brought on the by the potential shown on the potential tab.

Let’s think about that in two parts.

The negative reinforcement is pretty constant. The market is volatile. The volatility makes it uncomfortable for investors to pay attention to how they’re doing. Even great investments spend a lot of time in the negative column.

Why is this constant up-and-down, with a lot of down, a problem for investors? Negative reinforcement has a bigger effect on our perception than positive. Extrapolating from marriage and the ideal praise-to-criticism ratio we can expect that investors need a positive ‘up to down ratio’. That’s a lot to expect.

In order to really reinforce positive investing behavior, Stash (and everyone) has to think outside the box for metrics to make investors feel good about their investing habit. I feel very strongly about this “human element” of an investing strategy and changing people’s perception about investing.

I have created a free course that you might enjoy to help you have fun as you get started investing, and with metrics designed to keep you motivated to stick to you plan. Please check it out, I hope you’ll enjoy it:

A final word

While it looks like the list of cons is more thorough than the list of pros, don’t read into that too much. Stash is another way to accomplish the same goals as the Elephant’s Paycheck. Stash is a similar traditional investing approach without most of the human aspects of the Elephant’s Paycheck Blueprint. Stash uses modern technology to enable people to start modestly, build long term wealth, and most importantly, invest in alignment to their values.

Fees

Since I felt that the fees weren’t disclosed well enough in the sign up process, here you go:

$1/month, or 0.25% of balance annually (charged monthly, calculated daily) for balances over $5,000 (at $5,000 that’s just over $1/month).

Who it’s for

Stash, like my book, is great for people just getting started investing, or people who want an easy way to put something on automatic and let it accumulate.

As I said earlier, it’s not a good complementary app for Elephant’s Paycheck investing. Though is a good way to diversify some of your holding from individual stocks (that I recommend for the Elephant’s Paycheck portfolio) into funds.

The app itself doesn’t do anything to help you learn more about investing to build mastery around your decision making and habit. It would be great if each fund option linked to information / news about the fund. Because they’re funds, they’re too abstracted from the individual holdings to link to 10Q’s or quarterly conference calls, so that you can learn about your investments. I don’t believe funds have quarterly calls or the equivalent of 10Q filings. (Two other reasons I prefer individual stocks.)

The app is also amazing for people who want specific investments that align to their values. I love their focus to this goal. I know it’s important.

What I bought

Maybe I should have a disclosure page on this site, but I don’t. Mostly because I don’t make investing recommendations (I’m not advising, just educating). But for the review, I thought it would be fun to tell you what I did.

I have put $20 in a Berkshire Hathaway tracking fund. Of course, as I was writing this post I noticed that I lost $0.31 this week. You can see how by giving me no other way to describe my results, I’m forced to share something negative. To evaluate my performance in a way that might discourage you to give it a try. A shame, because you should.

If you’re curious how I track my performance, you’re going to want to have a look at this free email course on tracking investments for people who are just getting started investing (and may not be investing very much to get started):

I hope you like this review. I welcome comments below and private messages to discuss.

If you enjoyed this review… read my Robinhood review too. You’ll like it, as you would my book. And don’t forget to download Stash to give it a look. If you, like me, would rather buy individual companies (like Apple, Tesla, Google, or Snap, and more), try Stockpile. They’ll even give you $5 if you start with $10 or more. Read my Stockpile review here.

Disclosure: The links in this post are affiliate links. That means if you decide to invest with Stash I get paid. My integrity is worth more than any affiliate payment — I recommend Stash because it’s commendable not because it’s commissionable.

Hello, this sounds enticing. Though I am living paycheck to paycheck. Is stash a good idea for someone like me? I worry about my future.

Hi Kay,

Thanks for visiting. I worry about my future too, so we have that in common.

Stash is really good for creating a regular investing habit, especially if you have only a small amount to invest. With Stash, you can invest a specific dollar amount, without worrying how many “shares” you buy. With other apps that allow you to buy stocks, you have to buy “whole shares” and so if you are investing small amounts, and can’t buy a whole share, you’re stuck.

I feel, the best way to use Stash is to put away money on a regular monthly basis every single month and let it accumulate.

One down side to Stash is the cost. It’s $1/month. That doesn’t sound like a lot, but if you’re investing a small amount — say $10/month, that’s 10%. In other words, in order to make up your fee, you have to grow your investment by 10% (that’s a lot of growth). The way to think about this fee therefore is not as a commission, but as an opportunity to participate in creating a safer future. Without Stash, it’s hard to put away small amounts of money on a regular basis.

That said, I do discuss another way to invest small amounts in my book (http://ElephantsPaycheck.com/book) often without any fee/commission. If you’re curious, but aren’t sure about the book — check out this link to find out more: https://www-us.computershare.com/investor/3x/plans/planslist.asp?stype=all.

Finally, if you’re living paycheck-to-paycheck, you may have to really work to find even $10 or $25 a month to put away for the future. Good luck. It’s difficult, but rewarding. Drop me a line if you’d like to discuss more privately.

David

At 10,000 how much would stash get a month

Hi Eddie,

$25/year. Over $5,000 they charge %0.25 per year. Here’s the pricing FAQ that explains: https://www.stashinvest.com/pricing

David

Thank you David for your thoughtful reply. As an Android user, I see that Stash Invest will be available soon. I noticed the app Acorn and wondered what your thoughts on this are. Thank you.

Kay

Hi Kay,

I have Acorn on my list of apps to review. I have heard good things, but no first hand experience yet. I’m still working through my review of Robinhood.

Thanks for the point about Android — I can be forgetful that the actual phone matters, and I usually just talk from my perspective and I use an iPhone.

David

David,

Is Stash a bad idea for folks on disability. Becausei think anything you make would be counted as income.

Kay

Hi Kay,

I don’t know, you’d have to ask a disability consultant or perhaps a tax person. I will suggest that as investment income, I would suspect it’s not the same as “working”… but I have no experience to allow me to say that as anything but a speculation.

David

Rather than income, it’s declared as capital gains. I’m not sure on how it affects your situation but you should take it into consideration.

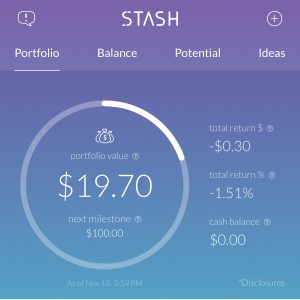

Hi Kay — For accounts over $5,000, you pay a fee of .25%, but I’d assume you’re also paying the ETF fees on top of that, no? Above, your Defending America Portfolio shows an expense ratio of .43%. So, for that fund, you’re paying .68% a year. Stash is probably great for those who don’t have a lot to invest initially, but one might be better off with a free brokerage account.

Steve

Hi Steve,

Really glad to have you participate. You’re correct mathematically (or at a minimum, directionally correct in regards to overall fees). However, a few things about Stash that I really like that don’t necessarily compare to a pure mathematical calculation:

1. With Stash, you can get started with as little as $5. $5,000 is a lot of money for many, and just saving that amount presents a pretty high barrier. For less than that, Stash charges $1/month. And, while that technically goes against the overall return (again, I agree with you), I think that there is a value to be had for making things accessible for people who are modest investors. On one hand, you might feel that a company that does that is taking even more than others from the people who can least afford it. On the other, it’s a company who is adding value by making investing small amounts possible, and that value should be paid for. You can think of the $1 as “continuing education” rather than as a “cost basis” expense if it helps to understand my point of view. If all the company was doing was making investing available to modest investors, perhaps I’d fully agree with you — they’re taking more from the people who can least afford it. (Though, technically the ETF fees aren’t something Stash is taking, the point remains). Stash does more… point #2.

2. Stash also, and this is really important, breaks down barriers to investing by explaining things in plain English. This is so important. Because the competition is not a “free brokerage” as you suggest, but is “not investing”. “Not investing” is not good for anyone. Stash is making investing approachable by letting people start with just $5 (point #1) but also by talking in plain English and making it easy for people to understand what they’re doing which gives them the confidence that they can do it.

I think many people underestimate how scary it is to invest if you’ve never invested before; how off-putting the language around it is. It’s almost as if it’s designed to put fear into newbie investors.

One more thing I’d add — I’m a big fan of Robinhood. In fact, I generally don’t like ETFs or Mutual Funds because they’re opaque (it’s hard to know what they’re up to) so for me, other than the fact that Robinhood doesn’t support dividend reinvesting, I’d personally prefer Robinhood over Stash. However, as I observe the Robinhood community, it appears people use it to trade, not to invest. I’m a huge believing in long term investing and I share that with Stash. They’re on a focused mission to help people build wealth, not gamble by trading.

I think it’s so important to build habits that help people (and families) to build generational wealth, that I’m willing to get past the ETF/Fund thing and support Stash as an alternative to buying individual stocks (in my preferred way of dividend investing).

Thanks again for commenting, and sharing. You were very clear, and I hope helpful to Kay.

david

just became a member can I buy MJNA CBIS AND PHOT using this app

Don’t believe so. Those are small over the counter issues… Stash offers ETFs.

I’m concerned about the security of Stash. I don’t have a lot ov money to invest but I want to get started. I got the app on my phone and started the registration process. I stopped when they asked for my SS #. They also need my checking acct. info.

Looking for some guidance.

Angie

Hi Angie,

The thing is, every brokerage is going to need your social security number.

In the case of Stash, they need your checking account number for a few reasons, not least of which is their business model and the $1/month fee which they take from your checking account (though not sure how you’d move money in to invest without doing that either).

I’ve given them both, with no issues. Think of it as another brokerage.

David

I just started with Stash today. I’m curious to see if it leads anywhere. I’m not investing much yet. I just want to get a little something started so when I start my 10-year plan in 2 years, I have something worth getting me started. I’m only investing $5 — an amount that I generally won’t even notice. If I like what I see, I will probably increase that amount incrementally. If not, my losses won’t be significant enough to hurt my finances. So far, this is what I like about Stash, from day 1.

Thanks for checking in! I agree with the sentiment that if you start small with an amount that you “generally won’t even notice” you can learn something and start to build healthy habits.

I really really enjoyed this article! Thanks I just signed up for the email coarse and looking forward to it.

Excellent. Please let me know what you think. (And if you like it, share it please!)