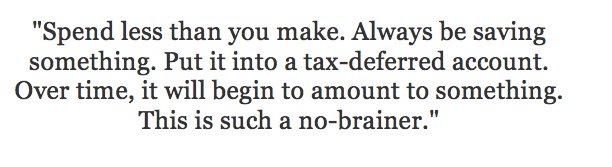

Even the phrase "dollar cost averaging" should put most people to sleep. Yet, here it is. Dollar cost averaging is an investing "strategy" that basically says, if you invest the same amount …

Continue Reading about Dollar Cost Averaging: What is it good for? →