I can’t even contain how excited Stockpile makes me. I have such a passion for investing by reinvesting dividends and having money make money. These guys seem to have thought of everything, and investing is as easy as it can be. You can get started with as little as $1. (Whether it makes sense to do that, is another story I’ll discuss later.). I couldn’t help but write a Stockpile review to complement my reviews of Stash Invest and Robinhood.

What is Stockpile?

Stockpile is the simplest way to get started investing in individual stocks, ADR’s (which enable you to invest in non-US companies), and ETFs that track some market indices or commodities (like gold).

With Stockpile you invest in dollar amounts (not share amounts). I mean, that’s it. It’s that simple. You can buy $25 of Apple or $10 of Tesla, or whatever your heart desires. (I bought $50 of Apple.)

What’s nice about buying in dollar amounts is that you don’t need to worry about the price of the share. If you’re investing for the long term, minor daily price movements don’t matter, and this enables you to invest more easily and with a lot less money to get started.

It also takes the focus off of the price at which you’re buying. I believe that when you focus on the price you pay per share, you become more hesitant because you want “the best price”. The best price doesn’t exist. Sure, if you’re trading, you’re going to want to maximize against tiny price movements. But if you’re just trying to build wealth over time, those tiny price movements are absolutely irrelevant.

Pick a good company, it’s going to be higher in five years than it is today, whether you buy it at the daily high or the daily low. Just get started.

For some reason (I have lots of thoughts on this), it’s just so hard for people to get started. Stockpile breaks down those barriers. In fact, it inspired me to create a free email course to help people understand how getting started through Stockpile helps them build wealth over time. You should subscribe, you’ll enjoy it and find it helpful (don’t forget, it’s free):

What I invested in

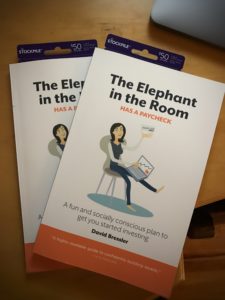

I wanted to see how they handled the integration of digital and physical, so I got myself a $50 gift card that could be applied to any stock. The card came in the mail overnight (even though I didn’t pay for expedited shipping!).

The gift card works like any other — scrape off the back, enter a code, and it’s redeemed. You can do this either online (that’s what I did) or via their mobile app. The process is really simple.

From there, you simply pick the company you want to invest in, and it’s done. Well, done except that you have to wait until the trade clears — which can be the same day, or the next day the market is open. Trades are made at the day’s closing price.

If investing isn’t the recipient’s “thing” they can cash out the card for a plain-old gift card. No penalty, no risk.

One thing is painfully obvious: The Stockpile team are very clear about their target market.

The Stockpile review: what does it mean to have thought of everything?

I said in my opening paragraph that Stockpile has thought of everything. What does that mean?

First, it’s important to understand their target audience. One thing to make clear, I’m reverse engineering what they’re up to — I have no insider knowledge.

A good place to start is comparatives: I’ve put up reviews of Stash and Robinhood. I really like what those guys are up to also, but they have different target markets than Stockpile.

Robinhood is a traditional stock brokerage rethought for the mobile and connected world. If you’ve understand buying and selling stocks, doing research, and tracking your portfolio using traditional metrics… Robinhood is for you. They’ve gotten rid of all the legacy cruft from traditional brokerages, including trading fees. It’s amazing, but it doesn’t really open the opportunities to build wealth to people who haven’t participated in the past. $8 a trade isn’t a barrier to investing. Investing is intimidating, that’s the barrier.

Stash addresses the intimidating nature of investing by using ETFs and more approachable language. I’d guess their target market are 20- and 30-something professionals (including modern professionals, like freelancers and solopreneurs) who think about investing as another aspect of managing the portfolio that is their life. I love Stash, and continue to use it, and absolutely love what they’re doing around educating investors to help them get started. It’s important work but investing in ETFs is not my preferred way of investing.

I started investing because I got a gift of five shares of stock when I was a teenager. I’ve since given stock as a gift to many, but the traditional way to do this is expensive. Minimum stock purchase amounts using traditional dividend reinvestment plans or direct purchase plans (also known as DRiPS) are usually in the $250 range. Plus, there are other barriers. In order to give the gift to a child, you have to have had a custodian in mind ahead of time, and have both the child’s and the custodian’s social security numbers.

Giving shares as a gift is a gift of knowledge. It cracks open a world of investing enough for the curious to climb right in. After I got my gift, I scoured bookstores to understand more about how it all worked. What better gift for a child, than the opportunity let their curiosity have a run?

It’s especially fun for kids to own a company whose products they use. Try taking your child to the supermarket to see their P&> or 3M product, or to visit “their” AT&T, Target, or Walmart store.

It’s especially fun for kids to own shares in a company whose products they use. Click To TweetStockpile seems to be going after someone who wants to buy and hold and not confusing it with an active trading strategy. They’re looking for the opportunity to teach kids about investing, through family (or community) connection.

That’s the opportunity Stockpile presents. I was able to buy two gifts of stock for a friend’s kids. They were smallish-gifts, a thank you for a big favor done for me. I didn’t have to know any private information about the recipients or their parents. All I needed was their home address. It couldn’t’ have been easier.

If the recipient is a minor, when they sign up they’ll have to have a parent present (it’s an SEC requirement). The parent will set themselves up as the custodian, and together with the child can pick their investment.

They get to pick their investment in a great way — they can pick a company they’re interested in. Interest begets interest… if they’re interested in the company, they’ll learn more about investing in the company. It’s just the way we work as humans. It’s a great way to spur a child’s interest in saving, investing, and how the capitalist world works (for better and worse).

I hope they play off this target and figure out a way to help people stay interested in their investments over time, and make it more of a group effort to do so.

Reinvesting dividends

Stockpile supports reinvesting dividends, on both mobile and web apps. However, the “switch” is on an account-by-account basis. So, if you want to reinvest dividends for one company but not another, you might have to check with support.

I highly recommend doing turning on dividend reinvesting. Small amounts of stock pay even smaller dividends. A few pennies or dollars in dividends will get “lost” in your wallet. Reinvested dividends won’t be missed from your wallet, but will accumulate to increase the paycheck and raises you receive from your investments.

I also hope they enable some sort of automated monthly investing options (often called “optional cash purchases” in traditional DRiP investing). Right now, I transfer money in automatically each month, but can’t assign that to an investment automatically.

Getting started with a dollar

Does it make sense to start with a dollar? Why, or why not?

The biggest objection is probably the fee. If the fee to purchase is $1 (it’s actually ¢99 plus a ¢3 credit card fee if you use a credit card, but I like round numbers) and you invest $1, you have to have your investment double just to earn back the fee!

Well, if you look at it that way, it sure doesn’t make sense.

But, if your alternative is to not invest at all… that $1 fee you pay can be thought of as the cost of education about how to invest. Instead of buying an investment book for $20, you’re actually investing for just $1. Not bad. Very zen in fact, learn through doing instead of by reading or planning. Don’t underestimate the value of having skin in the game as a motivator to learning more.

Of course, hopefully you can come up with more than $1 to get started. In fact, you have to as the Stockpile minimum is $5.

One challenge with investing a small amount of money is that the returns are equally small. If you invest $10 — and do extremely well — maybe you’ll earn $1 in the next year on that investment. $1 isn’t going to make much of a difference, is it? No, it’s not. Hard to get excited about earning a dollar.

Not so hard to get excited though about a raise. What if you got a 10% raise? That’s exciting. We all have to start somewhere, and if you have a modest amount to invest, it’s still better to get started than not. And, if you can get a 10% raise on your investment paycheck every year… well, that’s a larger raise than you’re probably getting at work. And, you’ll get it every year.

While I don’t want this post to be a pitch for my book, tracking the paycheck and the raise are really important motivators to build healthy investing habits. And, these metrics that I use couldn’t align more to the way Stockpile helps you get started investing.

I’ve created a free email course just for people who want to get started investing and learn more. You really should check it out:

Parents, grandparents, friends

I love the idea of investing with others. It sheds light into a subject we don’t talk much about — money. We use money every single day but hardly talk about it in any significant way. Crazy.

I love the idea of investing with others. It sheds light into a subject we don’t talk much about — money. We use money every single day but hardly talk about it in any significant way. Crazy.

I used to talk to my grandparents about investing. It was fun. We’d talk about what companies were doing, what we liked (or didn’t) about what they were doing, and what it meant in regards to the way the world was going. We could talk about Exxon and it’s impact on the environment, Starbucks and how people spent a lot of money on coffee, or Microsoft and the technology that my grandparents could never quite grasp.

Summary

I’m realizing this isn’t a typical review. No need. It’s so simple, just head over to the Stockpile website and check it out. At the bottom of the page they have a set of frequently asked questions which are a good place to start. Of course, they have an app as well, but I think you’d do better staring on their website.

Investing with Stockpile is a style of investing that’s been around for a very long time. Go to many public companies who pay dividends, look on their website for the investor section of the site. Usually under the area that talks about dividends you’ll see a link to something like “buy stock directly”. The way Robinhood is disrupting traditional brokerages, Stockpile is making these direct purchase plans more easily available and bringing them into the modern age.

If you have any questions about how it works or have your own experience with Stockpile, drop me a line or leave a comment below.

Update March 16, 2017

I continue to expand my use of Stockpile. I have moved all my holdings from Robinhood (who I love, but isn’t the best solution for me) to Stockpile, and moved my kids’ accounts over as well (Stockpile is really designed for families, and helping people get started investing even but not necessarily from a young age).

Update July 15, 2019

I’ve rewritten the final chapter of my book and will (eventually) create a new version/edition of my book with these minor changes. As it’s much easier for me to release these changes digitally via Gumroad, I’m going to release on Gumroad first. Subscribe to be notified when I do release to Gumroad. And, like in the past, there will be a substantial discount when I do.

Maybe the offer is no longer valid but I did sign up 04/25 using your affiliate link and did not recieve 5.00 to invest. I just wanted to let you know!

You have to use the link in my review. If you register directly from stockpile.com you won’t get the $5.

Good luck and congrats though. I hope you have fun with it.

David

There seems to be some issue with their referral process. I signed up on 4/24 using the link and I did not get the $5 automatically. I contacted Stockpile support and they told me I should receive it by the end of the day on 5/1. I contacted them again today and they told me they didn’t show my account as being eligible to receive the referral gift card. I had to send them the referral link I used to sign up, at which point they did send me a $5 gift card code. You should be able to get this as well if you contact them.

Hi Ben,

Thank you for sharing this information. I’ll reach out to them and see why they feel your account isn’t eligible so that I can make the review more clear.

David

I also just signed up today (5÷17) using your link and did not get the $5 either. I will contact support as well. Just thought you’d like to know it’s still happening!

Thanks so much for your reviews/posts!

Hey David,

Great article about Stockpile! I’m thinking about moving my loyal3 account since they’re shutting down their platform and transferring to FolioFirst. Any concern about Stockpile users abusing the company’s acceptance of credit card payments to fund stock purchases (by churning and burning just to get points on their cards)? This happened at loyal3 and they stopped accepting credit cards and only allowed bank transfers afterwards. Thanks for your input!

Earl

Hi Earl,

Sorry for the delayed response.

I don’t know what Stockpile will do about abuse/fraud. I do know that they are really committed to this space in a very “personal way”. I’m speaking more about their leadership being committed to fractional share purchases to help people get started investing.

Personally, I also have an account with Stockpile that I have for me and both my kids.

Notice that Stockpile has recently added a “reinvest dividends” toggle. I highly recommend turning it on and accumulating even more shares.

Please stay in touch.

David

I totally agree with you about stockpile. I have 4 stock transfer agents accounts for my drip accounts. I have two brokerage accounts to buy and sell stock.I opened stockpile account about a year ago and I am now buying most of my stock through Stockpile. My kids are in they’re mid twenties and they now have stockpile accounts and put in $15.00 a week in each of their accounts, let it build to $50 and buy some stock.it truly is a great deal.are now helping their friends open accounts and start investing

Hi Brent,

I love to hear that. I was just talking to the Stockpile guys yesterday and I’m hoping they add a feature for automatically adding monthly investing.

David

I bought my son stock through Stockpile

last year for his birthday.

This year I was going to buy him some more.

I asked him if he still had it.

He said he thought I had it.

I told him where I sent it,

it turned out to be his ‘junk’ email.

So he redeemed it this week.

I contacted Stockpile and asked them why

they never let me know

that he hadn’t got his stocks.

What were they going to do, keep it.

My son got his stock,

but he lost the gains that it grew all year.

It was purchased when he redeemed it,

at today’s prices.

They just now sent me an email,

said he’d redeemed his stock,

when and the value.

No “I’m sorry,” no nothing.

I will never do business

with them again.

Once they’ve got your money

piss on you.

Judi,

I’m so sorry to hear of your experience. Many companies struggle as they grow and I hope they implement notifications like you suggest to improve the platform for the future.

David

Hello

How did you move your holdings from Robinhood to Stockpile? Did you have to sell and reinvest?

I think that’s what I did because I didn’t have much and so the tax impact was minimal. There is a $75 fee to transfer ownership so it didn’t make sense to pay that fee.

David

Yes. I could have paid a fee to move them, I think $75, but I didn’t have enough invested to make that worth it. The tax implications for me were small as a result of the amount invested being small.

David

Hi David — thanks for the review! Feel free to use this link for your readers to all get $5 of any stock for free to try out Stockpile.

http://bit.ly/stockpiledb

Earn Money Join the Stockpile Affiliate Program

https://get.stockpile.com/affiliates/

Send free Stock Gift Cards for the Holidays

https://www.stockpile.com/free-holiday-gifts

I started Stash about a year ago and have a good amount invested in my ETFs. I like the idea of having pieces of various things through my ETF but the idea of having a single stock in say my favorite company is appealing as well. Do you recommend switching to Stockpile only? Or is it plausible to use both?

Hi Mary,

You definitely can use both.

I think both can be fun, and also educational in different ways. For example, you can see your returns on each and decide which has done better for you… or what the impact of the $1 fee Stash charges vs the $0.99 commission that Stockpile charges.

And, if you have minors who you want to introduce to investing, Stockpile is great for that… I have Stockpile accounts for my kids. Along that line of thinking, Stockpile also has gift cards, so you can give “healthier” birthday or holiday gifts.

By the way, I have some incorrect links that I’m trying to find. To setup Stockpile and get $5, please use http://bit.ly/stockpiledb.

David

Great article, David.

I opened an account yesterday on Stockpile. I started an initial investment of FB at $100 and then canceled the transaction. I then received a $100 Gift Certificate for FB and redeemed it immediately … nice! I’m not sure if that was a system glitch, or what, but sure was a nice surprise!

So I made some additional investments. A very simple way to invest and a lot of fun.

Craig

Thanks

I was thinking of doing this for a few months

The dividend part really got me into it now

Love to hear that. Please stay in touch.

Hi.

I have been using stockpile for a few months now and absolutely LOVE it.

With that said, I have not sold any of my shares so far.

I have read an article about it on another website (highya.com) where over 10 people left comments talking about how impossible it is to get them to transfer money from the stockpile account back into your own personal bank account and that made me extremely nervous about continuing to invest money on the site.

Do you have any experience with this? Have you had any problems with getting money transferred to your bank account once you decide to sell your shares?

I would hate to stop using Stockpile, but if this is an ongoing problem I might need to.

Please let me know.

Thank you so much!

I have not had this problem.

I had no problem with getting.my money back

I would not even worry about that

Do you still use this app a year later after switching so much over to it? Still like it as much?

Hi Rachel. Yes, I do. Possibly more because I love the results. Especially for my kids. I was able to buy them each about half a share of Amazon something I couldn’t do in many other places (if anywhere).

I’m not a huge fan of how they’re decided to present information. It feels like it takes more clicks/taps than it should to look at information but they have done a great job on simplifying any transactions and notification (which are more important to me).

I can’t express how much I love the way they’ve implemented custodial accounts to help kids get started investing.

Nice write-up on Stockpile! Keep on breakin it down for us common folk… I appreciate you brother.